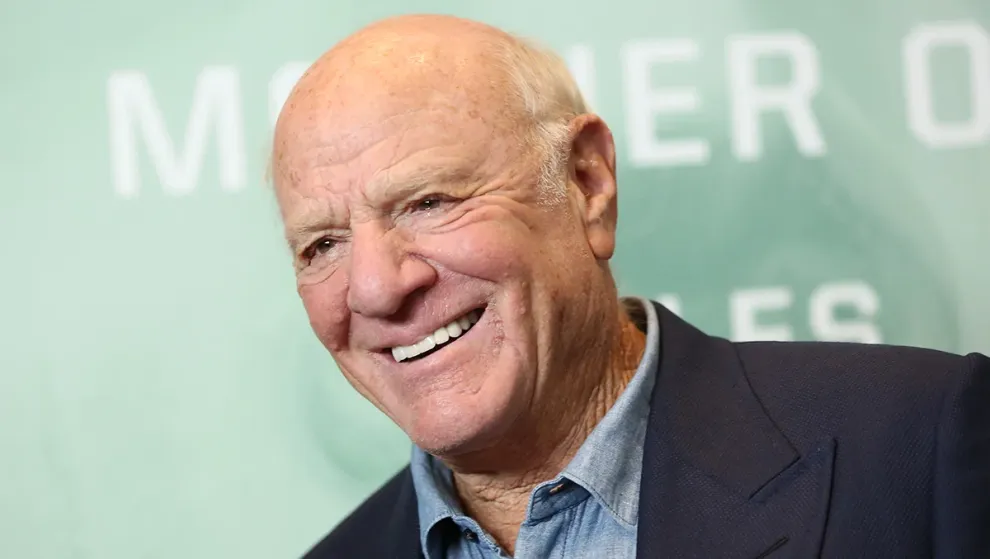

Barry Diller IAC Backs Out of Bid for Paramount Global

Billionaire Barry Diller said that his digital-media firm, IAC, has dropped out of the fight to acquire Paramount Global.

Billionaire Barry Diller indicated that his digital media conglomerate, IAC, has exited the race to acquire Paramount Global.

In an interview with CNBC, Diller stated that it is “hard to predict, but think it’s over for us,” signaling the end of IAC’s pursuit of the media giant.

Background

IAC was one of the contenders vying for Paramount Global, which recently secured a deal with David Ellison’s Skydance Media earlier in July.

The potential merger has stirred significant attention and controversy, particularly regarding its implications for shareholders.

Litigation Concerns

Diller expressed concerns about potential legal challenges, stating he would be “shocked” if there was no significant litigation related to the planned merger. Indeed, Paramount Global investor Scott Baker has already filed a lawsuit seeking to block the deal.

The lawsuit alleges that the merger primarily aims to cash out media mogul Shari Redstone’s investment in Paramount at a substantial premium, disadvantaging other stockholders who would receive a significantly lower payout.

Current Status and Future Prospects

Paramount Global has not commented on the situation, and IAC has not responded to requests for comment. The merger agreement allows Paramount 45 days to seek a better offer. If a more favorable offer emerges and Skydance does not match it, Paramount would owe a $400 million break-up fee.

This situation opens the door for other potential bidders, although the legal complexities and shareholder concerns may influence the outcome.

Share This

Tony Boyce is a seasoned journalist and editor at Sharks Magazine, where his expertise in business and startups journalism shines through his compelling storytelling and in-depth analysis. With 12 years of experience navigating the intricate world of entrepreneurship and business news, Tony has become a trusted voice for readers seeking insights into the latest trends, strategies, and success stories.