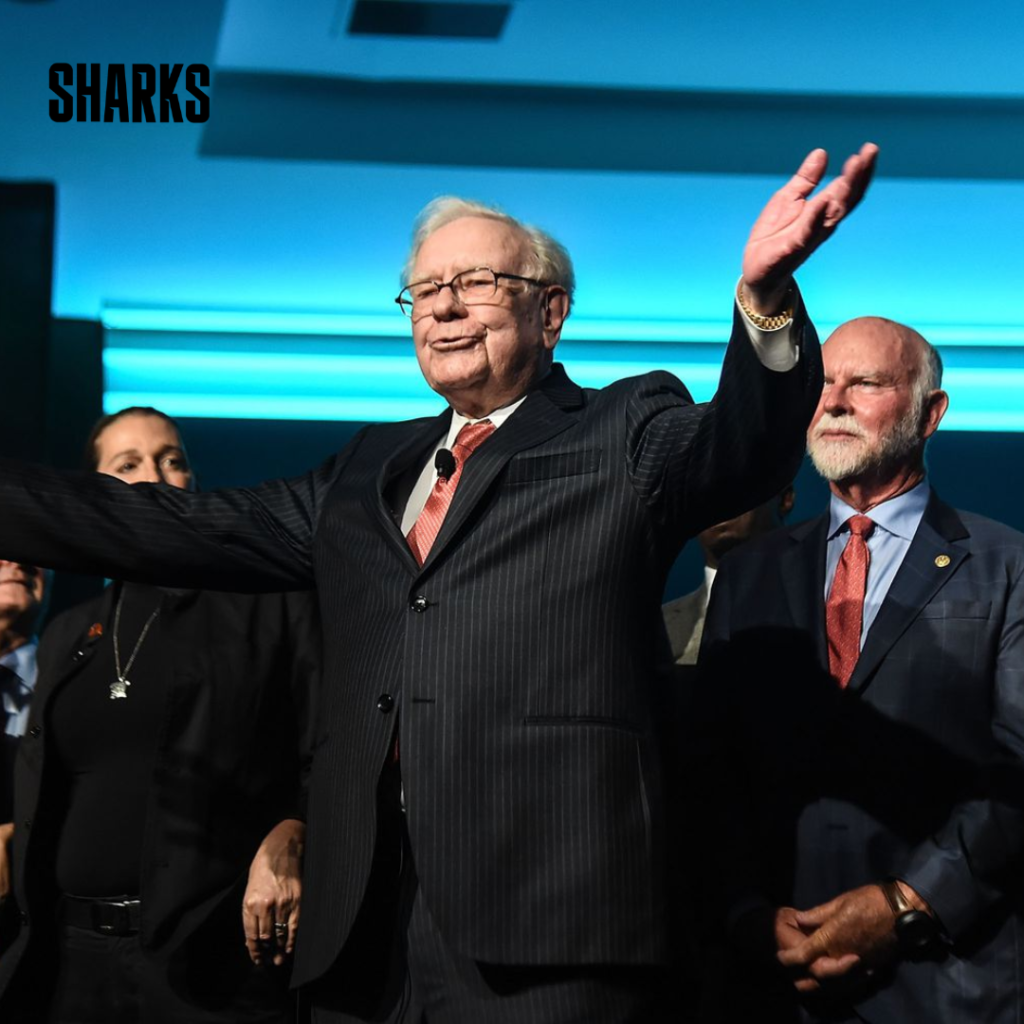

Berkshire Hathaway reduces stake in Bank of America

Berkshire Hathaway, the conglomerate owned by Warren Buffett, recently sold about 33.9 million shares of Bank of America.

A regulatory filing revealed that Berkshire Hathaway sold approximately 33.9 million shares of Bank of America for about $1.48 billion over multiple transactions this week.

After the sale, Berkshire owned roughly 999 million BofA shares.

Sale of Bank of America Shares

Berkshire Hathaway, the conglomerate owned by Warren Buffett, recently sold about 33.9 million shares of Bank of America.

This sale, which occurred over multiple transactions, amounted to approximately $1.48 billion, as revealed in a regulatory filing. Following these transactions, Berkshire Hathaway’s stake in Bank of America now stands at around 999 million shares.

Significant Shareholder Status Maintained

Despite this reduction, Berkshire Hathaway remains one of the largest shareholders of the Charlotte, North Carolina-based bank.

This sale does not significantly alter the company’s substantial influence and investment in Bank of America. In addition to Bank of America, Berkshire Hathaway has notable investments in other major financial institutions, including Wells Fargo & Co and JPMorgan Chase.

Long-term Investment Strategy

Also read: NTSB TO HOLD EXTENSIVE HEARINGS ON BOEING 737 MAX SAFETY AND MANUFACTURING

Berkshire Hathaway’s involvement with Bank of America began in 2011, a period marked by significant financial uncertainty for the bank. At that time, Berkshire made a strategic investment of $5 billion in preferred stock and acquired warrants to purchase 700 million common shares.

This move was pivotal, as it occurred when many investors were concerned about the bank’s capital requirements and overall stability.

Financial Sector Commitments

The recent sale aligns with Berkshire Hathaway’s broader investment strategy, which often involves adjusting its portfolio based on market conditions and company performance.

While the sale of Bank of America shares represents a significant transaction, it is part of a larger pattern of investment and divestment that the conglomerate regularly undertakes to optimize its holdings.

Conclusion

Berkshire Hathaway’s decision to sell a portion of its Bank of America shares underscores its dynamic approach to investment management.

Despite the sale, the company maintains a substantial position in the bank, reflecting its continued confidence in the financial sector.

Warren Buffett’s strategic investment moves remain closely watched by market participants, highlighting Berkshire Hathaway’s significant influence in the banking industry.

Share This

Tony Boyce is a seasoned journalist and editor at Sharks Magazine, where his expertise in business and startups journalism shines through his compelling storytelling and in-depth analysis. With 12 years of experience navigating the intricate world of entrepreneurship and business news, Tony has become a trusted voice for readers seeking insights into the latest trends, strategies, and success stories.